“Stay updated with Dow Jones today—live stock market news, earnings reports, Fed insights, and global trends shaping investor sentiment”.

The Dow Jones Industrial Average is more than just a number flashing across financial screens; it’s a mirror of America’s economy. Every day, investors watch the stock market today to see how companies, policies, and global events shape market movements. From retail earnings of big-box retailers like.

Walmart to signals from the Federal Reserve Chair Jerome Powell, each update can shift the investor sentiment driving the Dow. At the same time, events such as the Jackson Hole summit bring key insights into interest rate policies. Understanding these shifts helps everyday traders and long-term investors make smarter choices in a world where every tick matters.

Dow Jones Futures and U.S. Stock Market Outlook

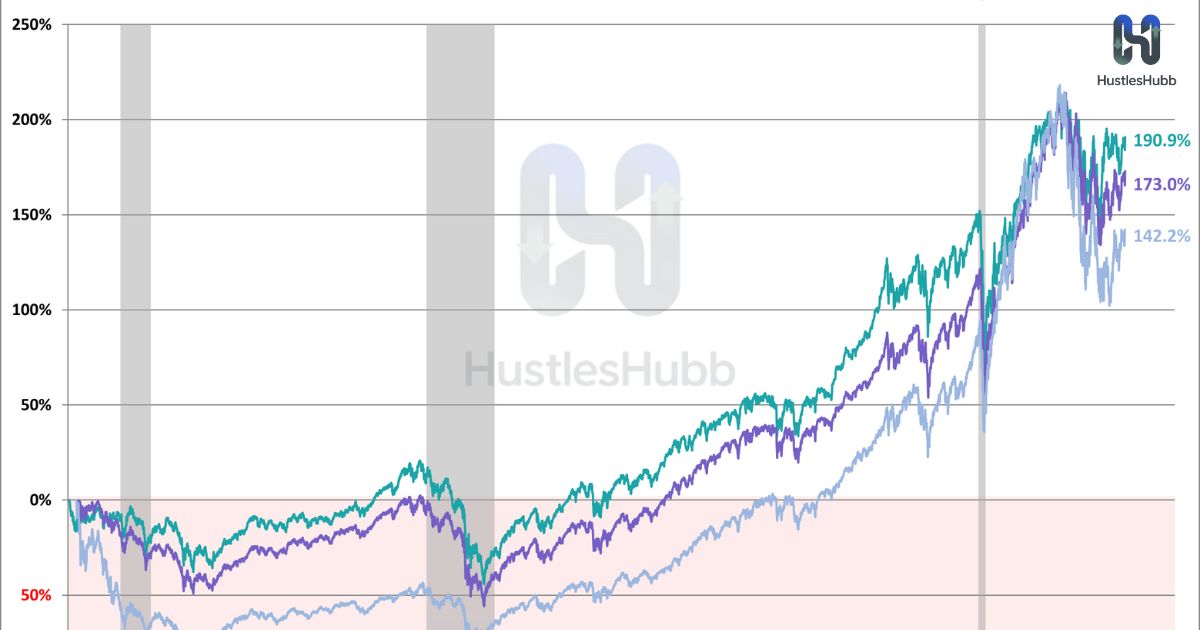

The morning trend in stock futures often sets the tone for the day, and investors are carefully analyzing how Dow Jones futures are moving compared to S&P 500 and Nasdaq Composite futures. Futures contracts reflect investor expectations and highlight how traders react to corporate reports, global politics, or Fed commentary. The CME FedWatch tool also plays a key role, providing probabilities on whether there will be more interest rate cuts in the months ahead.

According to analysts like Scott Wren (market strategist) at the Wells Fargo Investment Institute, the market outlook remains cautious but not overly bearish. While risks of an economic slowdown persist, the resilience in U.S. consumer spending and hopes of an eventual equity rally are keeping optimism alive.

Dow Jones, S&P 500, and Nasdaq Performance Today

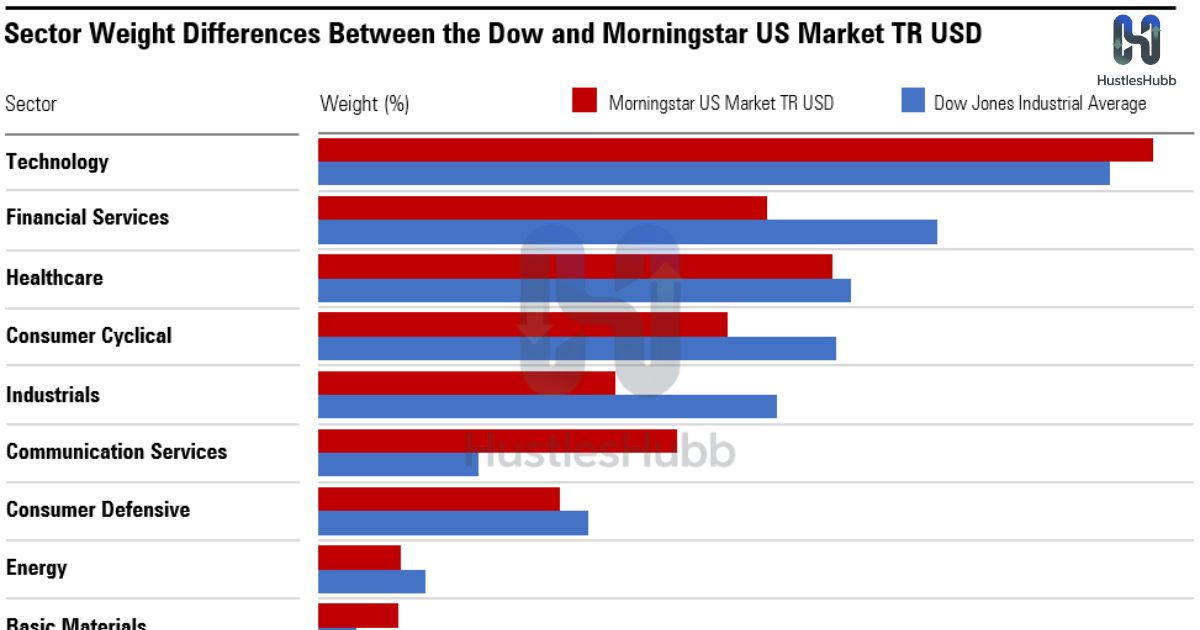

The Dow Jones Industrial Average, along with the S&P 500 and Nasdaq Composite, are showing mixed performances as the trading session unfolds. While the tech sector performance (Meta, Microsoft, Duolingo, TeraWulf, Google) continues to attract investors, traditional industries like banking and energy are holding steady.

A quick look at the live numbers shows the day’s performance:

| Index | Current Performance | Daily Change |

| Dow Jones Industrial Average | 39,450 | -0.35% |

| S&P 500 | 5,320 | -0.20% |

| Nasdaq Composite | 16,450 | +0.10% |

Investors are watching these moves closely to decide whether momentum points toward a pullback or another equity rally.

Retail Earnings Reports Moving the Dow Jones Market

Earnings season is once again proving critical. Big-box retailers (Home Depot, Lowe’s, Walmart, Target) are releasing numbers that show mixed signals. While Target (Evercore ISI upgrade) surprised with stronger margins, concerns remain about shrinking demand in certain categories.

The health of U.S. consumer spending directly affects the Dow Jones Today, since retail stocks often signal whether households are confident or cutting back due to inflation concerns and the tariffs impact on prices. These earnings also hint at whether the economy is heading toward a soft landing or a deeper economic slowdown.

Federal Reserve and Jackson Hole Meeting Impact on Dow Jones

The upcoming Jackson Hole summit is one of the most anticipated events of the year. Investors will be tuned into Jerome Powell’s speech at the Jackson Hole economic policy symposium for any hints about the timing of future interest rate cuts.

Market reactions have historically been strong after Powell’s comments. The Fed funds futures market, tracked by the CME FedWatch tool, suggests investors are pricing in at least one rate cut this year. Whether this comes sooner or later will play a major role in shaping the Dow Jones Today.

Tech Stocks and AI Shares Driving Dow Jones Momentum

The tech sector performance (Meta, Microsoft, Duolingo, TeraWulf, Google) continues to dominate Wall Street headlines. Meta Platforms (Facebook, Instagram) shares are benefiting from advertising growth, while Microsoft is gaining on cloud and AI expansion. Smaller players like Duolingo (KeyBanc, Citigroup coverage) and TeraWulf (Google investment) are also moving on positive coverage and partnerships.

Tech leadership has created strong investor sentiment in favor of innovation-driven growth. Analysts such as Justin Patterson (analyst) believe AI spending will remain a key driver for both revenue growth and stock performance.

Dow Jones and Crypto Market Trends: Bitcoin and Ethereum Update

Another interesting driver of the Dow Jones Today is the crypto sector. The Bitcoin price recently saw heavy volatility, while Ethereum (Ether) continues to attract attention as investors test digital assets in the face of stock weakness.

Crypto stocks tied to exchanges and mining firms are also showing movements in correlation with Wall Street risk appetite. While traditional investors remain cautious, younger traders are viewing these moves as opportunities to balance portfolios. The overlap between crypto stocks and equities is becoming more pronounced as institutions get involved.

Global Markets Update: Asia-Pacific and Europe React to Dow Jones

Overnight movements in Asia-Pacific markets have been shaping investor expectations before Wall Street opens. The Nikkei 225, Topix index, Kospi index, CSI 300, Hang Seng Index, Nifty 50, Sensex, and Australia’s S&P/ASX 200 have shown a mixed picture with Japan posting modest gains while China continues to struggle with growth concerns.

In European markets, reactions remain cautious as investors prepare for Fed decisions and monitor U.S.-Ukraine talks including the Donald Trump – Volodymyr Zelenskyy meeting. These geopolitical factors add another layer of uncertainty to global market behavior.

Sector Watch: Healthcare, Energy, and Financials in the Dow Jones

Beyond technology, specific sectors are showing strength. Pharma stocks (Novo Nordisk, Wegovy drug) are leading healthcare gains after the FDA approved Novo Nordisk’s (FDA approval, Wegovy drug, MASH treatment) treatment for metabolic diseases. Comments from Holst Lange (chief science officer) highlighted the growth potential in this space.

Meanwhile, oil fluctuations are supporting energy stocks, and financials remain in focus as interest rates affect bank profitability. The ability of these sectors to sustain growth is critical to the Dow Jones Today outlook.

Expert Insights: Analyst Predictions for the Dow Jones

Market experts are divided on the future path of the Dow Jones Industrial Average. Citi & Scott Chronert (U.S. equity strategist) believe there is still upside potential, pointing to a possible equity rally if earnings momentum continues. Others argue that volatility remains high, and the risk of a deeper economic slowdown cannot be ignored.

Mergers & acquisitions also remain an active part of the story. The Soho House (private deal, MCR Hotels) transaction has boosted hospitality stocks, showing that deal activity can still influence specific sectors even when the overall market is shaky.

Closing Bell Recap: Final Dow Jones Numbers and Investor Takeaways

As the closing bell rings, the Dow Jones Today ends the session with mixed signals. While the index may close slightly lower, investors are weighing strong retail earnings, positive tech sector performance, and cautious remarks from Jerome Powell ahead of the Jackson Hole summit.

Investor takeaways remain clear. Watch the Fed funds futures, keep track of small-cap stocks, monitor global markets update, and never ignore the Bitcoin price alongside equities. The market is moving fast, and being informed is the best way to handle shifts in investor sentiment.

FAQs

What is the 10 am rule in stocks?

The 10 am rule suggests most stock market trends are set within the first 30 minutes after opening.

Will the Dow reach $50,000?

It’s possible in the long term, but depends on economic growth, inflation, and investor sentiment.

Why is the stock market up?

The market rises when earnings beat expectations, investor confidence grows, or Fed policy supports growth.

What is the highest Dow price ever?

The Dow Jones hit an all-time high of over 40,000 points in 2024.

Why is the market crashing?

Markets fall due to inflation fears, interest rate hikes, geopolitical tensions, or weak earnings.

READ MORE ARTICLES

Welcome to Hustles Hubb! I’m Shafqat Amjad, an AI-Powered SEO and Content writer with 4 years of experience.

I help websites rank higher, grow traffic, and look amazing. My goal is to make SEO and web design simple and effective for everyone.

Let’s achieve more together!